Special Introductory price offer

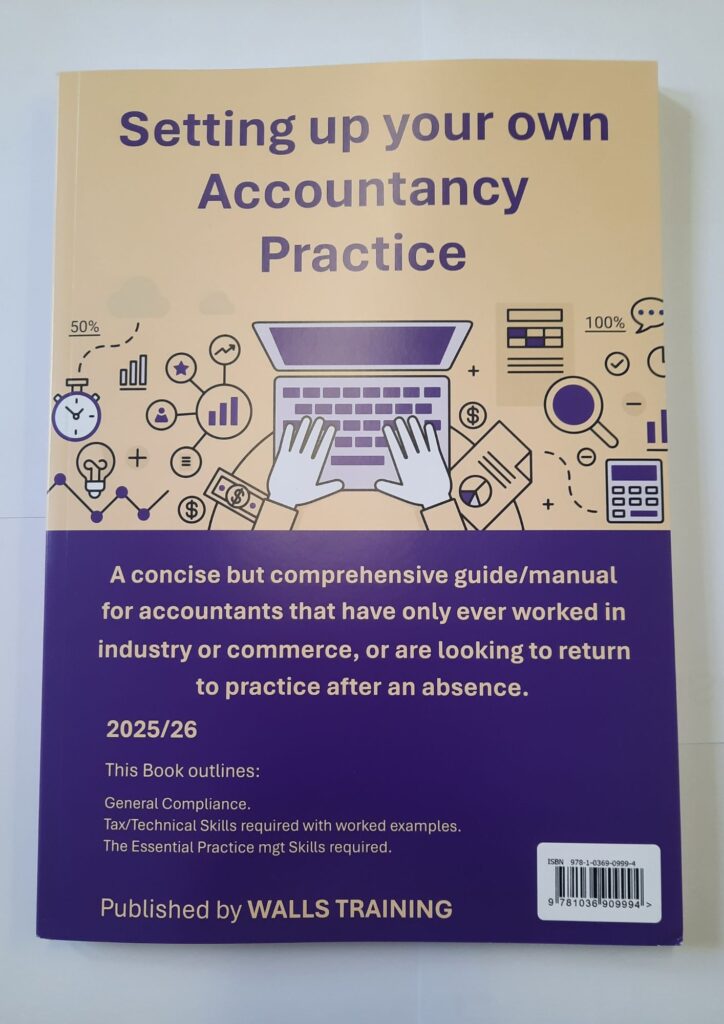

Setting Up Your Own Accountancy Practice

This new book is an Essential Guide for Accountants. Buy a copy of the book below for

the special discount price of £48.75.

A concise but comprehensive

guide/manual for Accountants looking

to set up their own practice.

Whether someone has previously worked in practice or

not, this book is deliberately written to impart the reader

with the necessary tax skills and knowledge necessary

to run a modern accountancy practice.

If you are looking to learn these skills from scratch or

simply looking for a concise refresher with a view to

returning to practice, this is the ideal book for you.

It should also be noted that learning the necessary tax

skills is only half the battle. This book/manual also

outlines many of the most effective modern “practice

management” skills and products commonly adopted by

sole-traders and many of the more successful

accountancy firms.

Thinking of going down the franchise route? This

book/manual is designed to give you all the information

that you need to set up on your own at a fraction of the

expense.

Looking to set up your own Accountancy Practice?

Buy a copy of this book now.....

This concise book contains, but is not limited to the following:

- General Overview

- Outline of the necessary regulations/compliance for setting up in practice

- Different business structures

- Bridging the gap between Employment and practice including a summary review of franchises and buying a practice.

- Tax /Technical Skills required

- Overview of the UK tax system

- Steps in Income calculation

- Review of Capital allowances with examples

- Basis of assessments

- Is it better for a director to take a salary or a Dividend

- When is a Dividend legal

- Methods of dividend extraction

- Who requires an audit

- Directors loan account reporting requirements

- Practice management

- Software requirements/review (both Bookkeeping and Tax)

- Where to increase your tax knowledge

- Marketing your business

- Pricing

- What to do when you get a client

This book is targeted at Accountants, that understand double entry bookkeeping,

the importance of the balance sheet, and that can put together a meaningful trial

balance. It is also assumed that they have a working knowledge of VAT.

Stuart Ferguson

Meet the Author

Stuart Ferguson is no stranger to the world of accountancy. With years of hands-on experience running his own practice, Stuart has established Chartered Management Accountants with offices in Falkirk and Edinburgh.

His firm serves over 300 clients, offering competitive pricing and exceptional service—excluding auditing. The reputation of his practice speaks volumes about his dedication and skill.

Prior to changes in GDPR, Stuart used to offer one day “transition courses” aimed at qualified accountants from non-practice backgrounds that were looking to set up in Practice. Over the years about 500 accountants successfully went through these courses, many of whom went on to run their own successful practices. This book is directly based on these successful courses.

“This book provides a thorough understanding of setting up your own practice without overwhelming you with unnecessary jargon. Perfect for accountants who have only worked in industry or commerce or returning to practice after an absence of many years. It’s a must read for aspiring Accountants looking to start their own practice.”

Stuart Ferguson